Content

If you would like more information about cryptoassets, you may wish to get financial advice before making a decision to invest. The performance of cryptoassets is volatile, with the value of an investment dropping as quickly as it can rise. There is no guarantee that cryptoassets can be easily converted back into cash.

It is possible that a national or supranational regulator may take unilateral action to legislate the cryptocurrency market in a manner which prevents or encumbers the proper operation of the market in your jurisdiction. This may impact whether we can offer the Cryptocurrency Service to you.

When you buy the underlying asset on eToro, you have the ability to transfer your cryptoassets to the eToro Wallet. This is an easy-to-use, multi-crypto, secure digital wallet.

If you’re looking to get your hands on Bitcoin or any other cryptocurrency, you’ll need to use a leading Bitcoin exchange or trading platform. If you want to sell your WAX tokens, the steps you’ll need to follow are essentially the same as the buying process outlined in step 3 above, except in reverse. It’s also important to be aware that crypto exchanges don’t offer every possible currency pairing, so it may not be possible to directly exchange WAX for the currency you want. WAX Tokens are utility tokens that allow virtual goods to be exchanged for cryptocurrency. Let’s take a closer look at how these tokens work and how you can buy WAX in the UK. WAX is a decentralised platform designed to allow users to create a fully functioning marketplace for online video game assets.

India to Propose Ban On Crypto

eToro is the world’s leading social trading platform, offering a wide array of tools to invest in the capital markets. Create a portfolio with cryptocurrencies, stocks, commodities, ETFs and more. This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as a reliable indicator of future results.

Because all of the information in the database is stored across the network, it’s said to be ‘decentralised.’ With a distributed ledger, any transaction that takes place on the network is recorded in multiple places at the same time. This means there is a higher level of security relative to a ‘centralised’ ledger, where data is stored in one place. The company’s investment platform, SoFi Invest, allows members to invest in a range of products, including stocks and equity-traded funds . The platform, which is currently available only to US residents, is popular among traders especially because of its $0 fee for stock trading. The platform first introduced Bitcoin trading in 2013, but has since become a more well-rounded exchange that offers various cryptocurrency products. There are many around, but the very best Bitcoin exchanges make it extremely simple to buy and sell cryptocurrencies using regular fiat money (the US Dollar, British Pound etc.).

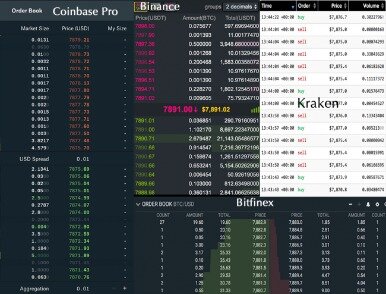

Best Bitcoin Exchanges Of 2021

Traders of such currencies put their trust in a digital, decentralised and partially anonymous system that relies on peer-to-peer networking and cryptography to maintain its integrity. Since the trading of Supported Cryptocurrencies is not subject to regulation, the Cryptocurrency Service is not governed by any specific European or UK regulatory framework. This means that, when you use the Cryptocurrency Service, you will not benefit from the protections available to customers receiving regulated e-money/payment services provided by us or one of our affiliate companies. You should carefully assess whether your financial situation and tolerance for risk is suitable for any form of exposure to cryptocurrencies. Exchange-traded funds are similar to mutual funds, but are traded on stock exchanges throughout the day, while mutual funds are traded based on their value at the close of trading. Canada’s principal financial regulator has approved the launch of the world’s first exchange-traded fund linked to Bitcoin, bringing the cryptocurrency a step closer to the mainstream. From major exchanges to banks, our industry leading blockchain analytics and AML solutions are trusted by countless entities to best analyze and manage risk.

- At this point, they can be traded into other asset forms, either other forms of cryptocurrency or fiat currencies.

- Cryptocurrency exchanges and the cryptocurrency trading market have generally been unregulated so far in Poland.

- Join SupraFin’s CEO and other CMU alumni leaders in the blockchain field on this online event, titled “What’s Ahead for Cryptocurrencies and Blockchain?.

- Other tax treatments may need to be considered by companies such as loan relationships and the intangibles rules.

Remember, you need a wallet to store your bitcoins in; ATMs are just ATMs, they do not offer any kind of wallet storage facility. Another potential issue is finding a machine which does what you want it to; some can be used to buy bitcoins and some to sell bitcoins, but machines that do both are scarce. These machines allow users to buy and sell bitcoins anonymously – there are none of the ‘Know Your Customer’ checks you will undergo if you’re looking to buy bitcoins with the majority of other companies mentioned on this list.

It helps you determine which are the best cryptocurrencies for you to buy. Should you only buy Bitcoin or a cryptocurrency a friend recommended to you? The SupraFin platform helps individuals buy cryptocurrencies in a smart, automated, transparent, simple, and customized way. If you have used a cryptocurrency to purchase software or gaming points, it is unlikely that you have made a profit and HMRC will not be worried about you. You can claim tax relief on the cost of software if it is used in your business.

If a company realises a capital loss on the disposal of exchange tokens, this can be used to reduce an overall gain on total capital disposals provided the loss is reported to HMRC and accepted as allowable. If a partnership or an LLP holds exchange tokens as an investment, the partners are liable to pay CGT on any gains they realise. Under section 104 Taxation of Chargeable Gains Act, 1992 and the pooling rule, each type of cryptoasset is kept in a ‘pool’. The consideration originally paid for the tokens goes into the pool to create the ‘pooled allowable cost’.

Traders who sign up with eToro get a virtual trading account with $100,000 in it to allow them to practise strategies before trading with real money. Whichever way you plan to buy your bitcoin, you must do your homework to ensure you understand how the company operates. In the same way that you probably wouldn’t feel comfortable making a large bank transfer on a friend’s mobile you’re not used to, you shouldn’t choose an exchange which operates from a platform you’re not fully comfortable using. Liquidity is how many bitcoins the exchange can sell before the price is affected.

Mining involves teams of computers solving mathematical problems. When the problem is solved, tokens for whichever cryptocurrency was being worked on are created, for example a bitcoin, and the computer that got the solution gets the new token. However, the more established Bitcoin and other cryptocurrencies become in the future, the more retailers and businesses will be willing to accept it as a legitimate currency. Cryptocurrencies are facing increasing regulatory threats and with continually fluctuating prices they do come with a high level of risk for investors. There are literally hundreds of different cryptocurrencies available, and all have different values. Think of them as a type of unregulated digital money although most are not particularly easy to spend, and all carry a high level of risk. These events will increase costs, and may also alter demand for trading cryptocurrencies.

Different cryptocurrencies also have different transaction times , depending on the type of cryptography used, the maximum size of each block, the incentive provided to the miner by the transferor and overall network activity. UK investors have flooded the market since Bitcoin started rallying in December, with almost £1bn traded for Bitcoin in the first week of January alone. Many are novice retail crypto-investors seeking to turn a quick profit and not wanting to miss out on the proverbial gold rush. ICO issuers might accept exchange tokens, like Bitcoin or Ether, in exchange for a proprietary coin or token that is related to a specific firm or project.

Bitcoin Cash

Its User Terms also limit liability for ‘failure of performance’ and like many other exchanges, it limits its liability for loss of profits. For example, if you were unable to buy Bitcoin during a 20% price surge, you would not be able to claim for the 20% increase. With Kraken, the maximum you can claim is the aggregate of the fees you paid to them in the preceding 12 months.

How do I buy crypto assets?

Buy Bitcoin on Exchanges

Bitcoin can be purchased via “fiat to crypto” exchanges. These allow you to buy coins with euros, pounds, dollars, etc. This can be done via Credit/Debit card or via Bank Transfer. This is today the most common way to buy online.

To answer this question, we need to look at the key economic features of cryptoexchanges. Being part of the Radianz community means that Gemini can offer its existing institutional customers a new way to confidently connect with their services. While also giving them a global reach to attract new customers. All underpinned by technology that can securely scale as their business grows. Adding Gemini to our network also means we can offer our community members better access to the growing cryptocurrency market. While Bitcoin is a digital currency intended as a means of payment for goods and services, Ripple is a payment settling, currency exchange and remittance system intended for banks and payment networks.

SupraFin was created when the founders realized the cryptocurrency industry (e.g., Bitcoin, Litecoin, Ethereum, etc.) had great potential. However, there were no platforms to help individuals invest in crypto in a smart way (i.e., select the best cryptocurrencies from thousands of cryptocurrencies and create a diversified portfolio that matches their risk preferences). When exchange tokens are exchanged for goods and services, no VAT will be due on the supply of the token itself. If exchange tokens are given as consideration for purchases of ‘stocks’ or ‘marketable securities’, this would not be subject to stamp duty as exchange tokens are not recognised as money. HMRC consider that exchange tokens do amount to ‘money’s worth’. This means that stamp duty reserve tax will apply if they are given as consideration for purchases of ‘chargeable securities’.

This is particularly the case if you are trading on behalf of others or borrowing money from a bank. This means that if things go wrong and someone tries to bring a claim against you, they could only enforce against the company’s assets rather than your personal assets eg your home. Exchange tokens, like other cryptoassets, operate using distributed ledger technology , like blockchain, and are not issued or backed by a central bank or other authority. To trade cryptoassets, you need an account with a trading platform that offers access to the crypto markets. Broadly speaking, cryptoassets are cryptographically-secured digital assets that can be transferred, stored, and traded electronically. In recent years, interest in cryptoassets such as Bitcoin, Ethereum, and XRP has grown exponentially.

Crypto Exchanges

If they fall within the description of readily convertible assets they are subject to PAYE and Class 1 National Insurance Contribution . They make a ‘tainted donation’, where a taxpayer donor enters into arrangements to obtain financial advantage. If the miner actually keeps the awarded assets, they may have to pay CGT or Corporation Tax on chargeable gains when they later dispose of them. Mining using a bank of dedicated computers bought for that specific purpose and in the expectation of a profit would probably be trading activity.

What crypto will explode in 2020?

Many experts believe that the chances of this happening are high. Perhaps the next two coins most likely to explode this year are Ripple and Ethereum. Ripple will likely bounce back from any issues with the SEC and there is so much happening with Ethereum right now, it may be hugely undervalued.

Different exchanges have different fees so it’s very important to make sure you know this information before committing. From a practical point of the view, bitcoin is often easier to use than fiat currencies. Bitcoin’s popularity sets it apart from all other cryptocurrencies; over time, it has moved closer and closer to what we recognise as a currency, rather than a virtual anomaly. In 2009, Bitcoin launched the cryptocurrency phenomenon as we know it today, and it remains the most popular currency of its kind worldwide. CRYPTOCURRENCY – a digital currency designed to work as a medium of exchange. There are two main advantages of trading crypto with CFDs.

Any delays to service when the price of the currency is so volatile will inevitably leave some users out of pocket. Coinbase expressly states in its User Terms that access to its services ‘may become degraded or unavailable during times of significant volatility or volume’.

It seems unlikely that HMRC is going to be concerned about what you purchase. Transaction fees paid before the transaction is added to a blockchain. AmountConsideration£160,000 x (3,500 / 4,000)£140,000Less allowable costs£200,000 x (3,500 / 14,000)£50,000Gain£90,000Melanie still holds a pool of 10,500 token B. She spent a total of £200,000 acquiring them, which is her pooled allowable cost. If Victoria then sold all 100 of her remaining token A then she can deduct all £84,000 of allowable costs when working out her gain.