Content

Despite being the biggest cryptocurrency exchange in South Korea, Bithumb becomes the second crypto-exchange to be under the investigation of the police. Reportedly, the Seoul Metropolitan Police is closely investigating the exchange to store essential shreds of evidence. Bithumb, the biggest South Korean cryptocurrency exchange is in serious trouble as the police investigates. “No security measures or regulations can 100 percent guarantee safety of virtual coins. It is held anonymously and in lightly-secured systems, which makes them an irresistible target,” Mun said.

- The police raid attributes to the executive officer of Bithumb facing accusations such as fraud.

- There is no existing blockchain-specific legislation or regulatory framework in Korea.

- That’s an estimate made by looking at counting the volume of Bitcoins that have been exchanged for various currencies.

- This is having a detrimental effect on the population, however, which is something the South Korean regulators want to prevent.

Hackers acting on behalf of the secretive state infiltrated and extracted more than $250 million (£195m) in cryptocurrency. Where the theft took place is a mystery, but the elaborate scheme the hackers used to move the funds back within North Korea has now started to unravel. Another issue that arises as the use of cryptocurrency increases is consumer protection. The Act on the Regulation of Terms and Conditions (the T&C Act) governs terms and conditions in contracts.

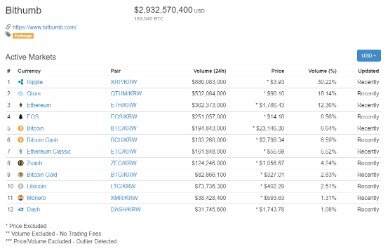

Despite, this positive news CoinMarketCap still reports that all top 10 cryptocurrencies are still down. Bithumb Global provides users with BTC, ETH, XRP, LTC, BSV, BCH, and other trading services like Spot and Margin Trading.

Bithumb: Hackers ‘rob Crypto

South Korea is the third-biggest market in the world for Bitcoin trades, behind Japan and the US, according to the digital currency website Coinhills. That’s an estimate made by looking at counting the volume of Bitcoins that have been exchanged for various currencies. And so on Wednesday the virtual currency – which last month looked set to breach the $20,000 (£14,500) mark – was trading closer to $12,000. The police raid attributes to the executive officer of Bithumb facing accusations such as fraud. Prior to the circumstances, Bithumb is another cryptocurrency exchange that came under investigation of the Seoul Police.

Is Binance better than Coinbase?

Coinbase vs Binance cryptocurrency exchange overall score comparison reveals that Coinbase has a higher overall score of 9.8, while Binance gathered an overall score of 9.6.

There is ongoing dispute regarding the grounds for tax assessment on virtual assets and this issue still remains unclear. Chapter XXXIX (Article 347 et seq.) of the Criminal Act governs fraud, whereas tort law under Article 750 of the Civil Act governs civil fraud. The government has been actively investigating and prosecuting fraud and other criminal acts related to cryptocurrency. The company offered 20 per cent of the new investment amount from new participants to the referee participant and provided other incentives to participants who were successful in attracting more investments.

All forms of data that fall under this definition, including those on the blockchain, are covered by the PIPA regardless of the format (e.g., encrypted, pseudonomized, etc.). Due to blockchain technology’s decentralized handling of data, it is unclear how Korea’s existing data and privacy laws will address specific uses of blockchain technology in Korea with personal information. The MSIT launched the “Blockchain Regulation Improvement Study Group” in May 2019 as part of its initiative to promote blockchain technology. This study group is tasked with reviewing key blockchain issues in relation to logistics and distribution, public services, healthcare, finance, and energy. Korean law generally does not require a particular form/structure in contract formation as long as there is an offer and acceptance between the parties. As such, a Korean contract does not have to be recorded in writing to be enforceable.

South Korean Crypto Exchange Signs With Security Companies To Lock Down Tokens

In practice, however, Korean banks decline to process wire transfers overseas when related to cryptocurrency trading, even if the amount is below the monetary limits and would not trigger the reporting requirements to the BOK or designated foreign exchange bank under the FETA. The main legal framework governing securities and investment in Korea is the Financial Investment Services and Capital Markets Act . There is no existing regulatory regime or statute that incorporates cryptocurrency into Korean securities and investment laws. Earlier this month, the country revealed plans to ban anonymous bank accounts in cryptocurrency trading from January 30. Like Paxful, they’re committed to providing opportunities to everyone in the world – the pooling of resources will help even more people gain access to financial freedom. South Korea remains the third-largest market for virtual currency, behind the United States and Japan.

Klaytn has recently listed its KLAY token with exchanges in Indonesia and Singapore. Another blockchain payment platform, Terra has announced in September 2019 that its mobile payment distributed application CHAI will partner with BC Card, the largest payment processor in Korea, to launch a debit card. Major online merchants including TMON, one of Korea’s largest e-commerce sites, now accept CHAI as a payment means. In December 2019, CU, a Korean convenience store chain, began accepting CHAI payment as well in all its approximately 14,000 locations. Moreover, the Bank of Korea announced its plan to initiate the Central Bank Digital Currency pilot project next year in cooperation with major companies and domestic banks. The two Chinese nationals used as many as 113 virtual currency accounts and addresses to launder funds on behalf of North Korean hackers and also operated in the United States without registering with the Financial Crimes Enforcement Network . However, mistakes were made with the hacking and money laundering surrounding the crypto exchanges.

In case the unreported amount exceeds 5 billion won, the accountholders might be referred for prosecution and have their identity revealed. The goal of the partnership is to strengthen the company’s systems and help secure other elements of its ecosystem. CertiK also conducted an audit of Terra, publishing a report on the stablecoin on May 4.

Users can use LINK to purchase contents (e.g., music, videos, webtoons), make in-app payments (e.g., games), and make in-app wire transfers to other individuals. In addition, commercial banks are also in pursuit of launching blockchain-based services such as payment and settlement, authentication, and virtual asset custody services. To do so, some of the commercial banks even formed liaison with existing virtual asset service providers.

North Korea’s Elite Hackers Are Funding Nukes With Crypto Raids

Paul himself had a very successful fencing career representing the UK at World Championship level and winning several Commonwealth medals. If you are interested in speaking to the FINTRAIL team about the issues discussed in this article or any other financial crime topic please get in touch via The usual governance applies, however this should also be extended to include an audit and regular reviews of the crypto transaction monitoring systems, as well as a review of the crypto-assets themselves that the VASPs are listing. An increasingly popular request from banks is that they require a look back on the VASPs transactions over a set period of time. This usually forms a report, and is facilitated by the bank by either asking the VASP directly, or requesting this information through a third party blockchain analysis provider. The monitoring of both fiat transactions, and the crypto transactions is very important. A customer’s transaction profile should be considered by looking at both of these elements.

“To obfuscate the BTC trail and decrease scrutiny, the North Korean co-conspirators engaged in hundreds of automated transactions with new BTC addresses as “peel chains” to four different exchanges,” the US government says. If the use of cryptocurrency increases in money laundering or for other criminal purposes, and in light of the Supreme Court’s decision holding that the government may seize cryptocurrency as criminal proceeds, the seizure of cryptocurrencies may increase. Typically, seized properties are sold through public auction with the proceeds going to the government. The Korea Asset Management Corporation, which manages Onbid, a public auction system, has indicated that public auctions would be possible for cryptocurrencies, noting cryptocurrencies’ similarities to securities. However, given the volatility of the price of cryptocurrencies, it may not be advisable to dispose of seized cryptocurrencies through a regular public auction process. The government has yet to decide how it will dispose of the cryptocurrencies seized in connection with the Supreme Court case.

Security tokens are strictly regulated by the government which distinguishes crypto-based investments from blockchain technologies. There are no rules that are directly applicable to tokens and virtual assets other than cryptocurrencies.

The court stated that the company received funds by defrauding customers even though there was no guarantee of recovering the original investment. In addition, there have also been investigations and prosecutions of fraudulent acts of cryptocurrency exchanges. Prior to the Amended AML Act, Korean financial regulators, such as the Financial Intelligence Unit , indirectly monitored virtual currency markets through financial institutions that are linked to cryptocurrency exchanges.

South Korea has attempted to tighten controls on cryptocurrencies and on Wednesday uncovered an illegal cryptocurrency foreign exchange trading worth nearly $600million. This crypto gold rush existed alongside limited regulatory oversight which created a fertile breeding ground for exploitation. This is evidenced through numerous controversies including exit scams, exchange hacks, price manipulation, and fake trading volume. Data from the Korean Ministry of Justice indicates that South Koreans lost $2.7 billion USD in cryptocurrency scams between July 2017 and June 2019. The ministry also said it has indicted and detained 132 individuals accused of cryptocurrency fraud and indicted another 288 individuals without detaining them. Earlier this year, the South Korean National Assembly passed one of the world’s first comprehensive cryptocurrency laws in order to provide a legal framework for cryptocurrencies and exchanges.

Each type of transaction has different procedures and requirements to remit funds overseas. Korea’s largest conglomerates have also contributed to the growth in the blockchain industry through various private investments. SK Telecom, Korea’s largest wireless carrier, announced its plans to focus on blockchain business. Specifically, SK Telecom plans to manage subscriptions, payments, and real-name authentication via blockchain.

The Korean regulatory authorities have not provided clear insight on the classification of cryptocurrencies under Korean law. Unfortunately, the FSS’ press release does not provide any guidance on how cryptocurrencies are classified and in what legal form. The hackers also stole nearly $2.5 million from a US-based company in September 2019 after gaining access to the company’s virtual currency wallets, funds held by the company on other platforms, and funds held by the company’s partners.

I understand that if I pay less Income Tax and/or Capital Gains Tax than the amount of Gift Aid claimed on all my donations in that tax year I may be asked to pay any difference. I understand that Weston Hospicecare will reclaim 25p of tax on every £1 that I give. This is following a revision that is related to the law with the operating licenses, which is going to be granted to those who are having money laundering prevention measures.

However, given the stance of the Korean financial regulatory authorities, it is possible that they would take an expansive view of the existing laws and regulations and cause difficulties for issuers. There are no explicit border restrictions or obligations to declare cryptocurrency holdings. However, for fiat currencies, the Foreign Exchange Transaction Act and the Foreign Exchange Transactions Regulations regulate the remittance of funds out of Korea to overseas accounts. Generally, there must be a legal basis, along with supporting documents as prescribed under the FETA, to repatriate funds overseas. Examples of a legal basis include loan repayments, dividend payments and sale proceeds payments. The FETA prescribes certain procedures and documents for each type of transaction listed in the FETA for both the remitter of funds and the bank handling the remittance. Generally, under the FETA, all outbound remittance in an amount exceeding US$3,000 per transaction or a yearly aggregate limit of US$50,000 must be reported to and approved by the Bank of Korea .

What company owns the only licensed Blockchain exchange?

Kraken (company)TypeBitcoin exchangeOwnerPayward, Inc.Key peopleJesse Powell (CEO)CurrencyCryptocurrencies: BTC, ETH, DOT, ADA, DOGE Real-money currencies: USD, EUR, JPY, GBP, CAD, AUD, CHFWebsitekraken.com4 more rows

According to the National Tax Service, the overseas cryptocurrency exchange users who fail to report overseas account balances of more than 500 million won are going to face a fine. The moves come as crypto exchanges are the subject of heightened scrutiny in South Korea and globally. With concerns about money laundering and with FATF guidelines beginning to have an impact, banking relationships are being tested and financial institutions in Seoul are refining their KYC programs and processes. The Korea Blockchain Industry Association estimates that South Korea has more than a dozen cryptocurrency exchanges. On June 11, another South Korean cryptocurrencyexchange Coinrail said it was hacked. The cyber attacks come after a high-profile theft of over half a billion dollars worth of digital currency at Japan’s exchange Coincheck earlier this year.

Coinbit, the third biggest exchange in South Korea was accused of conspiring and printing $85 million by manipulating the market. The executive officer at Bithumb, Lee Jung-hoon was accused of defrauding customers for allegedly selling BXA tokens and promoting them as Bithumb’s native tokens. Mun Chong-hyun, chief analyst at ESTsecurity, said digital coins would continue to be juicy targets for hackers around the world. “Since coins in the cold wallets are not at all wired to the internet, it would have been impossible for hackers to steal those in cold wallets unless they physically broke in,” said In, a blockchain expert at the research centre.