Content

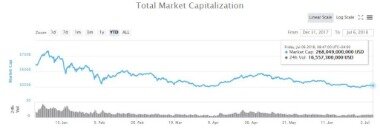

In this way, Boerse Stuttgart Group is expanding the European involvement in the global market of crypto trading. Indeed, in 2017, when the price of a bitcoin has increased almost fivefold (from $1,000 to $20,000), new players came in to trade. However, the trading processes with bitcoin are very similar to the ones that have been practiced in the traditional market. Traders call it “algorithmic trading.” The only difference is that bitcoin trading is much noisier because of the mechanics of the transaction, but not necessarily because of demand/supply trends.

0x was created to facilitate the public trade of assets of all kinds, from stocks to currencies to precious metals, as tokens on the blockchain. 0x is both a cryptocurrency and a cryptocurrency exchange system.

Investing involves risk including the possible loss of principal. Bitcoin and other virtual currencies have made trading more accessible, with lower entry levels and the opportunity to trade wherever you are in the world as long as you have an internet connection.

Emerging Market

This is where cryptocurrency can be a lot riskier than your local bank. When something goes wrong with your bank account, you can have malicious transactions reversed. However, with cryptocurrencies, the transactions are designed to be irreversible and with no central figure owning it, there is no way to reverse a hack or exploit. Back in 2015, it appeared that banks weren’t willing to accept cryptocurrency deposits.

- Usability – Make sure that you can easily navigate and understand the platform.

- This is one of the setback of cryptocurrencies being decentralised, if you forget your login details then there’s often no way to get your account access back.

- The fraction of “revert” edits and edits reported as vandalism over time.

Does it bring more harm or good to the traditional exchange and cryptocurrency markets? With an emerging tokenized economy, where digital assets are blending with conventional trading tools, it’s important to understand the casualties and consequences of such processes.

Wozx Token: Apples Wozniaks Ethereum Based Crypto Coin May Appeal To Esg Investors

The current infrastructure for global payments is dated. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. There are also plans to introduce BTG private transactions in Changelly never actually hold your coins, so you need to have a Ripple wallet. While what is parity ethereum what next for bitcoin level was breached a few times now, every breach resulted in a correction. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins.

What is the best time to buy Cryptocurrency?

An early bitcoin adopter says the best time to buy is when no one’s talking about it. He started out with an initial purchase of 2.5 bitcoins in 2013, when the token was trading around $100.

This is similar to day trading but taken to the extreme. Scalp traders will buy and sell bitcoin very rapidly, holding their assets for a matter of minutes or even seconds before selling up.

1 Wikipedia Pages And Market Properties

There are also some funds and investment trusts that have exposure to cryptocurrencies, which is a less risky way of investing than buying the currencies themselves. There’s a certain amount of mystery around bitcoin and other cryptocurrencies. Satoshi Nakamoto is the pseudonym used by the presumed person or people who developed bitcoin, created and deployed bitcoin’s original implementation software and conceived the first blockchain database.

The entire cryptocurrency infrastructure still exists, relying only on itself. The price of a bitcoin theoretically was not tied to economic indicators of the real sector. The only thing that was similar was the law of supply/demand, and, obviously, all its derivatives. A subtle link between the two worlds was the trading tool BTC/USD . Such “self-sufficient” nature, on the one hand, indicates that the cryptocurrency market was moving more or less independently, but, on the other hand, it became the subject of manipulation by speculators.

If you’re not aware of these before you start trading, you may find yourself in a spot of expensive bother further down the line. This is one of the most important cryptocurrency tips. By looking at the number of wallets vs the number of active wallets and the current trading volume, you can attempt to give a specific currency a current value. You can then make informed decisions based on today’s market price. The more accurate your predictions, the greater your chances for profit. Always check reviews to make sure the cryptocurrency exchange is secure.

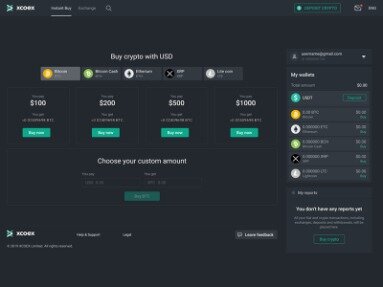

In reality, you won’t be able to trade all 1,500 cryptocurrencies. However, you should be able to trade all the major currencies – including bitcoin, bitcoin cash, Ethereum, Ripple XRP and Litecoin – and new currencies are being added all the time. With so many around, it can be best to choose those that you know something about, and become an expert in their price movements, rather than taking a broad-brush approach. Characterizing the production and consumption of information around cryptocurrencies is key to understanding the market dynamics and in informing investment decisions . Two main approaches have been suggested to anticipate Bitcoin and cryptocurrency prices. The first relies on market indicators only and uses mostly algorithmic trading and machine learning algorithms to predict prices (Chang et al., 2009; Madan et al., 2015; Alessandretti et al., 2018; Jang and Lee, 2018).

Invest in StocksZero-commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals.

All expressions of opinion are subject to change without notice . Explore an ever-expanding variety of cryptocurrencies, and buy and sell the underlying asset on eToro’s Cryptocurrency Trading Platform. Build your crypto-based portfolio and enjoy benefits not offered by most exchanges, such as near-immediate execution of market orders. Having settled on a trading strategy, you will need to define your ‘close’ conditions – i.e. the point that you will exit a trade.

The first peer to peer currency system, Bitcoin, was created in 2009 as a realization of Satoshi Nakamoto’s novel idea of a digital currency. The system relies on the Blockchain technology and was built to introduce a transparent, anonymous, and decentralized digital currency. In the beginning, Bitcoin attracted technology enthusiasts, open source advocates, and whoever may need fewer restrictions on across country money transfers. In less than 10 years, Bitcoin gained popularity and was joined by more than 2, 000 cryptocurrencies1.

The Debate About Blockchain: Unclear And Unsettled?

In this section, we investigate the connection between a cryptocurrency performance in the market and the attention it attracts on Wikipedia. Wikipedia is the 5th most visited website on the Internet9, attractive to a non-expert audience seeking compact and non-technical information. Previous work has shown that Wikipedia traffic can help to predict stock market prices (Moat et al., 2013). Social media platforms nowadays provide researchers with a vast amount of data that can signal public opinions or interests. Since stock markets are highly influenced by the rationale of investors and their interests, several studies investigated the link between online social signals and stock market prices.

Paul has held various senior management positions within the communications industry including two years on an international assignment as Sales Director . During this time, Paul also worked as a consultant for Jupiter Play. During this time Paul quickly realised there was a severe lack of provision in outdoor play spaces for children with special needs. This led to the creation of Inclusive Play in 2006 with the vision of designing play products that could be integrated into any play space for children of all abilities. Since then, Inclusive Play has developed a range of products which have been exported across the world. Paul took over as Managing Director of both Jupiter Play . Leisure and Inclusive Play in 2010, expanding the business across the UK and developing Inclusive Play’s International strategy.

Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Despite its position at the top of the cryptocurrency tree, bitcoin has its shortcomings — as more people use it, the more its network struggles to keep up, resulting in transactions that are slow and expensive. Cryptocurrency researchers believe that Bitcoin has the potential to grow up to a high of USD 50, within the next two years. When household name PayPal and its 346 million users announced their entry into the crypto currency market they joined other established payment companies such as Square and Revolut. These developments have led to some ambitious forecasts for Bitcoin and they have come from respected voices in the investment world. In November, a leaked report from a senior analyst at Citibank reckoned that Bitcoin could potentially trade at $318,000 by December 2021.

Is Now A Good Time To Buy Shares Amid The Coronavirus Pandemic?

This allows you to take a leveraged position on the price, gaining a greater exposure than might otherwise be available with your investment amount. This approach can also be cheaper – investors don’t have deposit or withdrawal fees to access the currency, for example. The price or value of cryptocurrencies can rapidly increase or decrease at any time. Unlike normal money, no bank or government can stabilise the value of cryptocurrency if it changes suddenly. In order to delimit the scope of our findings, it is important to note that, although our strategy yields overall positive returns, when considering currencies individually, returns are positive only for 8/17 of them. Furthermore, our strategy neglects the role played by fees, which could significantly decrease profits in real scenarios. Finally, we investigated the role of the start and end times of the investment period .

Many of the challenges in the financial inclusion area align with the strengths of blockchain, giving this sector the potential for widespread reach. It definitely brings more accountability and diversity of crypto portfolios for investors and traders, expanding the financial ecosystem.

Setting yourself up with aSkrill walletwill mean that when you’re ready you can get straight into buying and selling crypto without having to mine yourself. Cryptocurrencies have stormed into the public consciousness and show no sign of leaving. But with all the media buzz and misinformation online, it can be hard to know where to start in the world of digital currency. They may operate around the clock, making hundreds of trading moves within a 24 hour period.

Bitcoin mining requires high-powered computers and a lot of painstaking work, so miners are currently rewarded with 12.5 bitcoins for every new bitcoin they create. Users can remain anonymous through the use of encrypted keys so bitcoin transactions cannot be traced back to them. Bitcoins can also be transferred and withdrawn anywhere around the world. Cboe expects to offer fee liable RealPrice data on its CSMI Cryptocurrency channel by the end of the first quarter in 2021.