Content

If you only want to buy/sell BTC, then the spread (i.e. the fees) is 0.75%. That’s more than you’ll pay on a cryptocurrency exchange , but cheaper than cryptocurrency brokers . You’ll get the most accurate exchange rates and pay the lowest fees if you use a cryptocurrency exchange. In these places, you’re free to withdraw YOUR cryptocurrency from their platform and take it wherever else you like at any time. It gets worse too – as the exchange rates they quote aren’t the spot rate you’ll find on cryptocurrency exchanges like Binance or Coinbase Pro. I’ve reviewed some of the most popular cryptocurrency exchanges and brokers in the UK and ranked the best ways to buy Bitcoin in the UK in this short and sweet list.

It is used to identify when the user last visited the website.VISITOR_INFO1_LIVE5 months 27 daysThis cookie is set by Youtube. Used to track the information of the embedded YouTube videos on a website. CookieDurationDescription__cfduid1 monthThe cookie is used by CDN services to identify individual clients behind a shared IP address and apply security settings on a per-client basis.

Has Coinbase been hacked?

Coinbase prides itself on being an exchange that has never been hacked.

Whether holding cryptocurrency themselves or through a custodian, building robust risk mitigants that cover both physical and cyber security is essential to any cryptocurrency holder. “We have five different zones of security at our sites, including digital, physical and human security,” explains Miles Parry, Founder and CEO of Vo1t, a global custodian of digital assets. Robinhood burst onto the financial services scene in 2015 with commission-free trading of stocks and exchange-traded funds .

The Rise Of The Cryptoexchange Giants: What Next For Trading Cryptocurrencies?

Like any fast developing space mushrooming with new technologies, there are higher quality cryptocurrencies and lower quality ones. To make matters worse (from a miner’s perspective), the ‘difficulty’ of the competition increases as more miners get involved; this is done to avoid issuing new bitcoins too quickly. The block reward also halves every four years, making them much more expensive to produce. Like a share or a house, bitcoins are worth nothing more or less than what other people are prepared to pay for them. In the early days Bitcoin traded for $1 per bitcoin; it peaked at around $20,000 (£15,400) in 2017 before plunging to around $3,000 (£2,300) then settling around $8,000 (£6,200). A database of financial transactions which constantly grows as new transactions or ‘blocks’ are added to it, forming a continuous and public chain of data.

You can create an account on a cryptocurrency exchange, but this is not a default cryptocurrency account in the same way that you have a bank account. For the extra paranoid user, you may want to store your seed in a fireproof safe. They store your private keys offline so they can’t be hacked. Any time a wallet is connected to the internet, it has the potential to be hacked. On the home page, enter a password, then select the “Create New Wallet” button.

As per HMRC the tax treatment of Bitcoin and Cryptocurrencies, the general rules on foreign exchange and loan relationships apply’ and that they have not at this stage identified any need to consider bespoke rules’. However due to the “evolving” nature of the cryptocurrency market means it is likely that further guidance is likely to be produced in future. Merchant where cryptocurrency is accepted you can receive cryptocurrency for good and service provided. There are growing number of outlets in UK already accepts cryptocurrency payment. Also, you can earn cryptocurrency when you provide a service such as mining service or exchange service. As with all new technology – it takes time for regulators to catch up. Cryptocurrencies are not yet being fully implemented into the legal framework of many countries across the globe.

Deposit Fees

You can keep your bitcoins at an exchange – some offer cold storage, which is similar to the way that bullion dealers often offer gold storage. Taking a measured approach to securing insurance for cryptocurrency firms is a must. Insurance options are likely to evolve too, especially as insurers gain more confidence in the risks. Policies are currently written in fiat currency, but many firms would like to see the limits in a variety of cryptocurrencies. This would remove the risk of limits failing to keep up if there was a rally on the value of a cryptocurrency.

- Such risks includes the risk that you may be following/copying the trading decisions of possibly inexperienced/unprofessional traders, or traders whose ultimate purpose or intention, or financial status may differ from yours.

- 25A coin is a cryptocurrency used as an exchange of value, such as Bitcoin.

- Popular cryptocurrency exchanges can take severe amounts of income that they serve from the various methods discussed in this article.

- Merchant where cryptocurrency is accepted you can receive cryptocurrency for good and service provided.

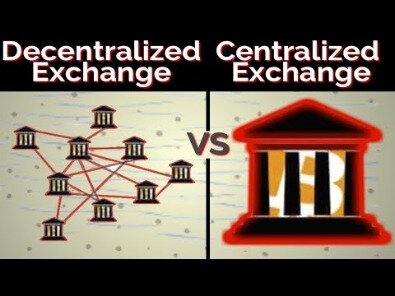

It is very hard, if not impossible, to shut down or interfere with. 36 The BGCI is a an index that measures the performance of the largest cryptocurrencies traded in USD. 24Based on trading values on 27 April 2020, when the concentration ratio for the top five exchanges was 47%. This can create a virtuous cycle whereby userbase growth perpetuates and the market tips to a small number of providers. On this last point, once a coin has been bought or sold, the exchange will ensure its immediate transfer. The first miner to solve the problem records the answer in the decentralised blockchain along with its private key, thereby lengthening the chain.

As more and more money is created, it erodes the value of the existing money in circulation. People don’t necessarily notice this erosion because the nominal amount of their money remains the same; however, they do notice that their weekly shop, eating out, and watching movies costs more and more money. The ‘normal’ money we use today is actually rather unusual in the history of money, in the sense that it is no longer itself precious . Instead, it operates over a global network with thousands upon thousands of nodes – a machine within a network like a computer or some other device – which together process and store transactions. In this Q&A, we ask Dr William John Knottenbelt, director of the Imperial College Centre for Cryptocurrency Research and Engineering, to help us better understand this cryptic kind of currency.

They will often encourage you to make a transaction, but this will be fake, meaning you’ll lose your cryptocurrency or investment as a result. With the prices of cryptocurrencies increasing dramatically over the last few years, scammers are now actively targeting potential investors. The results often mean investors lose their original investment. statistics show that in June and July 2018 people lost more than £2 million to cryptocurrency scams – that’s over £10,000 per person.

The eToro wallet is a great way to secure your Bitcoin while making it easy to access at any time in the future. The eToro wallet allows you to send and receive cryptocurrency from other wallets, while maintaining security in a multi-signature solution.

Things You Need To Consider When Buying Bitcoin

Popular alternatives include, Ethereum, Litecoin, XRP , Cardano and more. International matters – If the client trades internationally, things could become complex as there is no consensus as to the treatment of bitcoin in different jurisdictions. HMRC’s guidance includes extensive commentary on the meaning of ‘trade’. HMRC’s view and its general approach in establishing whether or not a trade exists.

Second, the cryptocurrency marketplace is a target for fraud, so extra caution is needed. Also, many exchanges have been subject to cyberattacks during which people who have left their holdings on these exchanges have lost them. To store and use your cryptocurrency you’ll usually need a specialised ‘wallet’ which will have its own unique digital address, allowing you to send and receive cryptocurrencies. There are literally hundreds of different cryptocurrencies available, and all have different values. Think of them as a type of unregulated digital money although most are not particularly easy to spend, and all carry a high level of risk.

nits of cryptocurrency are created through a process called mining, which involves using computer power to solve complicated maths problems that generate coins. Users can also buy the currencies from brokers, then store and spend them using cryptographic wallets. Cryptocurrencies use decentralised technology to let users make secure payments and store money without the need to use their name or go through a bank. They run on a distributed public ledger called blockchain, which is a record of all transactions updated and held by currency holders. Several exchanges have begun doing so-called “wash trading,” a practice in which they artificially enhance the volume they report on websites that display specific cryptocurrencies’ market capitalization.

The instability of cryptocurrencies does means that it’s possible to make huge gains with small amounts of investments. But it’s also possible to make huge losses in a relatively short space of time.

Bitcoin For Beginners

With some of the most famous exchanges facilitating volumes of billions of dollars, it becomes apparent how lucrative these ventures will become. Digital asset exchanges should see increasing volume and commission revenue as the cryptocurrency market matures and expands. Users use Binance Coin to pay the fees charged by Binance for the use of the services. These fees include, but are not limited to, trading fees, exchange fees, and fees for the inclusion of digital assets in the Binance exchange.

As of January 2018, Binance was the largest cryptocurrency exchange in the world in terms of trading volume. However, it takes the security of its users’ assets seriously and stores most of the deposited assets offline in cold wallets. The exchange has made it known that over 90% of the assets are at any given time stored in cold storage, with less than 10% in hot wallets. The platform focuses on security, robustness, and execution speed — attracting enthusiasts and professional traders alike. Whether you’re a long-time trader or just curious about cryptocurrency, Magnum Wallet will allow you to manage and exchange your BNB securely and efficiently. Compared to storing tokens and coins on an exchange, here you have full control of your funds, and no personal information is collected in the process.

Are There Concerns About Cryptocurrency?

In addition, like any other cryptocurrency, BNB can also trade on accepted cryptocurrency exchanges. Binance has quickly become the number one stock exchange in the world, with a daily trading volume of more than $6 billion. Binance, like many exchanges, also has its own currency called Binance Coin BNB. It is mostly used to pay fees, but can be traded like any other cryptocurrency.

There are numerous places to buy bitcoin available and we would always recommend that you conduct your own thorough research and due diligence before making your own personal choice. Whichever way you plan to buy your bitcoin, you must do your homework to ensure you understand how the company operates. Fees, especially, can change significantly from region to region – a US-based exchange, for example, may offer great rates to a selection of US states but the prices may ramp up for a European country. Lastly, the unstable nature of the currencies means that if you’re investing with the hope of making money, it’s very easy to lose some or all your original investment. But because of the anonymity of the transactions, they are also frequently used by criminals seeking to avoid detection for unlawful activities. Cryptocurrencies are only a digital representation of value which isn’t issued or guaranteed by a central bank or public authority. A global ban on bitcoin is unlikely – unless the world descends into some global totalitarianism, at which point illegal bitcoin will be among the least of your problems.

Popular cryptocurrency exchanges can take severe amounts of income that they serve from the various methods discussed in this article. When you first get into cryptocurrency, one of the first things you’ll need to do is choose an exchange to trade on. When choosing a cryptocurrency exchange, there are a lot of things to consider.