Content

I’ve checked through Revolut’s website and it looks like this insurance only applies to your devices (if damaged/lost/stolen) and purchase protection. This doesn’t touch on the cryptocurrency you’re getting exposure to through their app. However, XRP has a 2.45% spread – with other cryptocurrencies having a higher spread than this. XRP has been delisted from some places recently, but it’s still available to buy cheaply in multiple places (e.g. Binance or Solidi). I think you’d have more luck posting in /r/BitcoinUK or jumping on the UK discord channel. There are a variety of people lurking around who I know will be more helpful than this. Your other option might be to talk directly with Kraken (and whatever exchange you’re looking to send money to).

Take your time to build your knowledge and get to know the best places for cryptocurrency research online. Cryptocurrencies have stormed into the public consciousness and show no sign of leaving. But with all the media buzz and misinformation online, it can be hard to know where to start in the world of digital currency. CFD, share dealing and stocks and shares ISA accounts provided by IG Markets Ltd, spread betting provided by IG Index Ltd. Registered address at Cannon Bridge House, 25 Dowgate Hill, London EC4R 2YA. Both IG Markets Ltd and IG Index Ltd are authorised and regulated by the Financial Conduct Authority.

Alternatives To Bitcoin

I’m not comfortable with this risk, so I only leave a little on exchanges like Crypto.com, Coinbase Pro, or Binance. Not knowing all the above I already purchased bitcoin worth €200 with my revolut account. Now I want to get out of this and I’m wondering what is the best way to do this. There are also “cold storage wallets”, where the private keys aren’t connected to the Internet.

- Check out this post for a list of just some of the options out there.

- While Bitcoin is the most recognised cryptocurrency, there are a number of other digital currencies available.

- This might mean it takes you longer to get verified (something that’s necessary to buy on any exchange with GBP).

- Trade a handful of leading cryptocurrency coins against the US Dollar.

- We’ll spend the amount of emoney you told us you want to spend .

Crypto assets that meet the definition of a security are subject to regulation by the Securities and Exchange Commission under US securities laws. The SEC regulates securities transactions, broker-dealers, investment advisers and other securities market participants. In the United States, trading of crypto assets is regulated by many different agencies at both the federal and state levels. Laws governing exchanges vary by state and federal authorities define the term ‘cryptocurrency’ differently. A large number of cryptocurrency exchanges operate outside the major Western countries to avoid regulation and prosecution. You would be well advised to consider the domicile of each exchange as a factor in making your choice of which provider to go with.

What Services Do Cryptoexchanges Provide?

The blockchain system is very secure, making it difficult to break into people’s Bitcoin wallets. Scammers often use platforms like Facebook, Instagram and Twitter to trick people into these investments.

All contents on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalised advice before you make any trading or investing decisions.

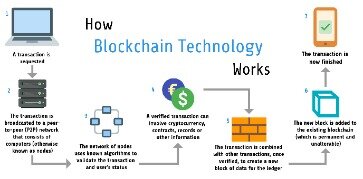

Bitcoin is an extremely risky investment and you should only consider investing if you’re financially equipped and willing to lose any money that you put into it. They come in the form of digital devices that can be connected to your computer so that you can make transactions. There are several types of Bitcoin wallet, each offering different levels of security, anonymity and control over your cryptocurrency. There are a number of exchanges available including Coinbase, Coinfloor, Kraken and Bittylicious. Blockchain aims to cut out middlemen, such as banks and online market places like eBay and Amazon, when it comes to trading with one another.

Can Cryptocurrency make you rich?

Investing in cryptocurrencies is one way people are using to get rich; become a millionaire. But it doesn’t mean you become a millionaire instantly. You have to research and analyze every coin to make decisions that brings you fortune. Indeed, cryptocurrency can make you rich overnight.

An important reason why so many cryptoexchanges exist, and why the active number is ever-changing,32is likely to be the limited entry barriers. These are essential questions to ask yourself when researching. Those two points are the very basics that you should expect an exchange to utilize, but several other issues related to the technology you should investigate further. This is a way of doing business that is unethical and exploits those just starting out trading more often than not. If you are using a trust-based system, this means that you will need to deposit a certain amount into a wallet to prove that you have sufficient funds . There are several different methods that an exchange will create revenue. However, it can sometimes be difficult to tell exactly how they make enough money to keep what seems to be their complex operations running.

Self-regulation also combats one of the drawback of every country potentially having different regulation, which makes it increasingly difficult for companies to operate on a global scale. Self-regulatory bodies have more opportunity to collaborate with each other and introduce global regulations that are consistent and meet the needs of investors and cryptocurrency companies.

If you’re a Premium or Metal Revolut user , then this fee is reduced to 1.5%. These services can work the way they do due to the usage of a mix of other exchanges. Different sources are used to find the coins you need, so you may be sure that everything will be found in the shortest terms. To change money, you should open the website, select the coins that interest you, enter the sum, wallet, and complete the exchange. Just like the previous option, this also in a non-custodial exchange, but it works slightly differently. First of all, this variant is one of the easiest ones to use. Also, they provide a broader choice of currencies than retailers and the transactions are instant.

What Is Margin Trading And How To Use It To Become More Profitable

Since we dealt with a cryptocurrency exchange and real money , we paid special attention to this stage. The main goal here was to ensure that the user would always have the right data in real-time regardless of his/her activities. A company that owns a variety of blockchain services was looking for a reliable software development firm that would build a cryptocurrency exchange web application. The company’s investment platform, SoFi Invest, allows members to invest in a range of products, including stocks and equity-traded funds . The platform, which is currently available only to US residents, is popular among traders especially because of its $0 fee for stock trading. Starting in February 2018, the platform began to allow its users to trade cryptocurrencies as well. It started with just Bitcoin and Ether and has gradually increased the number of coins that can be traded on the platform.

There may be other features that attract traders to smaller exchanges. A liquid market allows traders to quickly buy and sell reasonable volumes of an asset at a similar price without having a significant impact on prevailing market prices. This can create a virtuous cycle whereby userbase growth perpetuates and the market tips to a small number of providers. Bitcoin and other cryptocurrencies are permissionless forms of blockchain technology that rely on a ‘proof of work’ concept to verify transactions. A cryptocurrency is a digital or virtual currency secured by cryptography. Bitcoin, invented by the elusive Satoshi Nakamoto and released in 2009, is commonly regarded as the first cryptocurrency. Nevertheless, most exchanges create their revenue by above-board means and often at little expense to the platform’s user.

However, it’s likely that deposits in other countries could take a few working days to process. Reading back over Shirley’s comment, it looks like she was referring to withdrawing cryptocurrency from Revolut – not GBP. Revolut’s functionality is currently limited to just buying, selling, and storing – but deposits and withdrawals of cryptocurrencies are not permitted.

You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money. Today, it still requires some level of technological understanding to utilise cryptocurrencies to their fullest potential. As more projects and developers work on user interface and design, cryptocurrency offerings will become easier to use for the average person with little to no technical knowledge. Once this happens, watch out, because there will be no limit to how high cryptocurrencies can grow. Still, you can rest assured that as long as there are use cases for cryptocurrencies and these assets provide an improvement over fiat currencies, they will hold a place in the global economy. To better understand this, you first need to understand the different types of cryptocurrencies on the market. Each of these types of cryptocurrencies holds value for its own reasons, and as such, it is not accurate to compare and contrast cryptocurrencies with different functions.

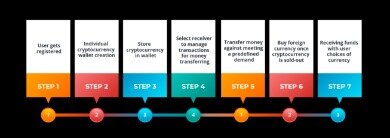

In addition to wallets you can also trade your currency on exchanges. Some of these will also allow you to convert your everyday currency – £, $, € and so on – into cryptocurrency, and to convert your holdings from one type of cryptocurrency to another. If you simply want to trade cryptocurrency you just need a brokerage account, rather than accessing the underlying exchange directly.

Register a claim and give us some time to conduct an initial feasibility assessment. During that time, we will decide whether we can assist you in the recovery of your stolen crypto. There are many different types of fraud, each with different characteristics; therefore our initial review of your claim request requires significant upfront analysis. After you submit a Reclaim Crypto claim, Coinfirm’s analysts investigate each case in terms of data compliance. Where any crucial information/documentation if missing, we will reach out to you to obtain additional evidence. Our technology allows us to detect the source and destination of misappropriated funds, which allows us to examine multiple cases at the same time.

In the crypto markets, a market maker is an exchange that is actively quoting two-sided markets in a cryptocurrency, providing both bids and offers/asks along with the market size of each. Market makers provide liquidity and depth to markets and profit from the difference in the bid-ask spread. Think of this as your guide to day trading cryptocurrency and you’ll avoid most of the hurdles many traders fall down at. When choosing your broker and platform, consider ease of use, security and their fee structure.

You have complete control of your cryptocurrencies, and we will only act upon instructions you give us. if you click ‘confirm order’, your instruction will be submitted. We’ll spend the amount of emoney you told us you want to spend . if you click ‘auto-exchange’, your instruction will be submitted. If the target rate is hit, and if we accept your instruction, we’ll buy the cryptocurrency from our partnered cryptocurrency exchanges, such as Coinbase or Bitstamp. if you click ‘exchange’, and we accept your instruction, we’ll buy the cryptocurrency from our partnered cryptocurrency exchanges, such as Coinbase or Bitstamp.

But the difference in volatility means traders have to rely on different strategies in order to make a profit. User experience and functionalities is a critical factor to consider, especially if you’re trading cryptocurrency for the first time. Exchanges with good user experiences attract the largest growth in transaction volumes.

Pepperstone offers trading on the major Cryptocurrencies via a range of trading platforms. BinaryCent are a new broker and have fully embraced Cryptocurrencies. In addition to offering many alt-coins to trade, BinaryCent also accept deposits and withdrawals in 10 different crypto currencies.

The early phases of younger cryptocurrency exchanges are inevitably characterized by minimal volume. Due to this, these exchanges cannot rely exclusively on commission revenue during their growth phase. The digital asset exchanges may also offer a service that allows users to list tokens and coins to drive initial revenues. With some of the most famous exchanges facilitating volumes of billions of dollars, it becomes apparent how lucrative these ventures will become. Digital asset exchanges should see increasing volume and commission revenue as the cryptocurrency market matures and expands. The technology underlying these exchanges allows users to trade in a very liquid and flexible market. As a result, there is never a point where one type of virtual currency overruns another.

Others have seen investors spend their money being digital coins only for the developers to make off with the cash themselves. Hackers have taken advantage of digital coins and can target exchanges and accounts, in one case crashing one of the world’s largest cryptocurrency exchanges. One of the ongoing criticisms of cryptocurrencies, whether valid or not, is that it is being used by terrorists and money launderers. Ensuring members properly screen their customers or analyse usage on their exchanges for trends that might indicate criminal activity could be one way of improving the image of the industry.

Bitcoin’s volatile price has led to sudden peaks in interest as its value goes up. This has surge in professional and amateur speculators investing in bitcoin and other cryptocurrencies, seeing them either as a quick way to make returns or as part of an investment portfolio. Cryptocurrencies use decentralised technology to let users make secure payments and store money without the need to use their name or go through a bank.