Content

But it’s also possible to make huge losses in a relatively short space of time. However, people have been increasingly buying cryptocurrencies for the purposes of investment, hoping to make a lot of money quickly. Mining involves teams of computers solving mathematical problems. When the problem is solved, tokens for whichever cryptocurrency was being worked on are created, for example a bitcoin, and the computer that got the solution gets the new token. Bitcoins and cryptocurrencies are created through a process called mining. Anyone can mine for most cryptocurrencies, but it is a difficult and time-consuming process.

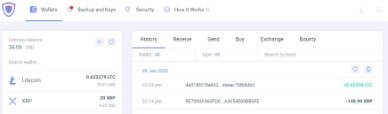

Now you have your wallet, it’s time to get rid of your common pounds, dollars, euros – or whatever currency you use – and invest in the future. These wallets also usually have the added benefit of allowing you to store different currencies in the same place, so if you get bitcoin fever, you have somewhere to store all those alternative coins you fancy buying. Supply your wallet ID to a seller so that an exchange can take place. Visit a reputable website that will let you exchange your Fiat currency for bitcoin.Fiat currency is a term used for any legal tender whose value is backed by the government that issued it. Since the beginning of 2017, the bitcoin price has soared from $1,000 up to the recent record-breaking amount of $17,000. When you’re starting out, remember to take one step at a time and you’ll be confident with how to buy and sell. For example, you can learn more about dollar-cost averaging or look into the histories of some of the major cryptocurrencies to understand more about them.

Join Lloyd’s Market

The buying and selling of cryptocurrencies is done on cryptocurrency exchanges. A trader needs to open an exchange account by filling out an online form.

Is it easy to sell Cryptocurrency?

If you have bought and held Bitcoin via a major all-in-one wallet and exchange provider, such as Coinbase or Blockchain.com, you can sell it via their built-in exchange. This is the most straightforward option. The way fees are charged varies: some but not all will pass on the exact transaction cost to you.

The digital currency that most will be familiar with is free from government interference and can be shared instantly online. Find out how bitcoin and the blockchain works, so that you have some understanding of the system, the ledger, the major players and the public and private key elements. As mentioned above, digital currencies are volatile and not for the faint-hearted. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76.4% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

By mid-January, it raced to a record high near $4 a coin – and Alex said his account had grown to €34,000 (it’s measured in euros as it is Slovenian based) from roughly €4,000 invested. However, Alex says when he went to invest, the website was sticky and slow. It left many nervy investors wondering if they’d be able to cash out, if they so wished. For example, Coinbase charges 3.99 per cent on debit and credit transactions, or 1.49 per cent for a standard buy/sell. Since then, the bitcoin price collapsed from $12,000 to a low of around $3,000 in December 2018. Another popular wallet is Electrum, which is a wallet for desktop computer use.

You will not be able to transfer cryptocurrency to outside the Revolut platform, e.g. external wallets. We are actively working on bringing this functionality to you in the future. However, you can still buy, sell and exchange within the Revolut platform. CYBAVO VAULT allows you to easily manage all your accounts and cryptocurrencies from an intuitive interface.

Those who have made profits from buying and selling digital currencies may be left a little confused about whether or not they need to pay tax. They claimed that cardano – a third generation digital currency – will rise by more than 8,000 per cent from $0.78 a coin to $68. Two that were being tipped to grow in 2018 from a low level by a panel of four fintech leaders for price comparison website Finder in a cryptocurrency predictions survey were cardano and stellar lumens . At the time of writing in January 2018, many believed bitcoin had peaked – or reached a point in which they cannot make some of the astronomical gains made by early investors, which has, as of May 2020, held true. Some websites offer investors the chance to take a punt on cryptocurrencies, but not actually own any of their own. A raft of case studies recently in the Financial Times revealed problems cashing out their profits, with some banks suspicious of where customers had received huge sums.

If You Do Buy Into Bitcoin

Three centuries later, the Lloyd’s market continues that proud tradition, sharing risk in order to protect, build resilience and inspire courage everywhere. It offers the efficiencies of shared resources and services in a marketplace that covers and shares risks from more than 200 territories, in any industry, at any scale.

In the aftermath of the hype, prices fell, but these currencies were still left more valuable than they had been before. Serious investment sites now cover cryptocurrencies, and investors include them in their portfolios. Conventional electronic payment takes place through banks, with payment processing companies as intermediaries.

Make sure the one you select offers fiat-to-crypto exchange – that means buying Bitcoin with normal currencies such as euros or pounds. Popular exchange Coinbase is one of the easiest options for beginners. There are a range of ways to purchase Bitcoin, but the most common is through cryptocurrency exchanges, such as Coinbase.

Cryptocurrencies have several advantages over ordinary currencies, most of them stemming from the direct nature of cryptocurrency payments. Companies from Japan to America and the Middle East are creating cryptocurrency ATMs and payment systems that allow cryptocurrency to be used in shops. These currencies have more practical value than before, increasing demand for applications such as SingleCoin, which let people buy, store and spend cryptocurrency using their phones.

Please make sure that you have entered a valid email address. After placing the order, please wait minutes for the email to be sent. If you made the deposit after the order has expired, we can still process it – but the rates may change, reflecting the rate at the time of your deposit. To prevent theft and scams, when you place an order above a certain threshold for the first time, we may require additional identification verification. When you share your private keys with someone, you are essentially depositing all of your funds into the hands of that person. This article is designed to be used as a simple guide and should be read with the caveat that the information is correct at time of going to press and has been written with desk research rather than personal experience.

How To Purchase Cryptocurrencies Using Wechat, Exodus & Coincola App (2017, China)

Many paper bitcoin wallets use software such as QR codes to allow you to quickly scan in the information when you want to buy/sell bitcoins. The offline function of the wallet makes it extremely resilient against cybercrime, although you would need to take precautions to ensure that the document is held securely. If you’ve been reading any of our latest articles about the growth of cryptocurrencies then you’ll undoubtedly be aware of the need for a digital bitcoin wallet. This is a secure online location where you can store your private key in a safe space, with resilient checks to prevent cyber theft. Everyone who kept cryptocurrency on the cryptocurrency exchange account at the time of its fork, should be credited with the new forked coins or the equivalent.

- Coincover protects $300M+ of crypto, spanning 200+ different cryptocurrencies, held in more than 15,000 wallets.

- Your identity will be verified using up to 2 forms of ID , and a residential address.

- The price can move by 20 per cent in one day and you could easily lose half of your cash in a far quicker time that investing in the stock market.

- Because they don’t rely on any third parties to handle the data, they do have a strong security element.

- The parameters considered in prioritization of cases relate to the feasibility of recovery, number of victims and value of claims.

In order to transfer, log in to your existing account and complete the online application form. Please check your current provider to see if they have any charges for transferring.

Whether you’re simply grabbing a few Bitcoins to experiment with this new currency or you’re a more seasoned digital currency investor, your process will remain similar. Brokers that offer cryptocurrency CFDs can only accept fiat currency methods for deposits and withdrawals. Therefore, it will be common to see bank wire options, credit/debit cards and/or e-wallets, such as PayPal, Skrill, and Neteller, being used for transactions on these platforms. Funds must be transferred from sources that bear the account holder’s name, as anonymous funding is not permitted. Bank transfers usually have an unlimited capacity for deposits and withdrawals, but bank cards and e-wallets can have limits defined by the CFD provider.

The developers have also done a nice job of keeping most of its complexities from ruining the user experience. We wouldn’t suggest it for advanced cryptocurrency users, though, primarily because the ability to set custom fees is currently restricted to Bitcoin only.

First released in 2014, the Trezor Model T is the company’s premium offering, designed to suit both HODLers and active traders alike. For starters, Mycelium is entirely open source, which is one of the most essential features for any good cryptocurrency wallet. The app also relies on the Simplified Payment Verification technique, which allows it to confirm transactions without having to download the entire blockchain. Though they are still wary of cryptocurrencies themselves, banks and other financial institutions have started researching how they can use blockchain in their own processes. Until recently, cryptocurrency hasn’t been widely seen as a credible alternative to conventional payment, but that’s changing. A surge in the market value of cryptocurrencies last year drew widespread attention from investors.

However, it should be noted that each wallet has its own maintenance which could add to the time that you spend on your Bitcoin account. We’ve previously talked about how the term ‘bitcoin’ covers a myriad of currencies, from bitcoin itself through to Bitcoin Cash and Bitcoin Gold. Although they may have started in the same way, they have forked off to become currencies in their own right.

The transaction is done twice, and in opposite directions to complete an exchange cycle with the goal of profiting from the exchange. Bitcoin is just one type of cryptocurrency, a form of digital asset or money that can be exchanged in a similar way to normal currency. There’s no physical money attached to a cryptocurrency, so there are no coins or notes, only a digital record of the transaction. Using a bitcoin ATM means the money should arrive almost instantly, and exchanges and wallets will usually have the cryptocurrency waiting for you shortly. A cryptocurrency is a digital or virtual currency designed to work as a medium of exchange. It uses cryptography to secure and verify transactions as well as to control the creation of new units of a particular cryptocurrency.

In essence, cryptocurrency is a digital currency the generation and transfer of which is regulated by encryption methods. If you’re in camp number 1, then you’re best off with our Editors’ Choice Exodus. This cryptocurrency wallet is easy to use and supports a huge number of digital asset types via the distributed exchange ShapeShift.

It is therefore imperative to carefully consider how and where your private keys are stored. For example, some wallets will store private keys offline, while others will hold them online. Lloyd’s has launched a new insurance policy to protect cryptocurrency held in online wallets against theft or other malicious hacks. There are countless cryptocurrency exchanges from which to buy Bitcoin.

As you can see, there is much to consider when choosing the best bitcoin wallet for you. This article has given you some initial guidance into the types of wallets available and who they are suited for.

They are both backed with millions in venture capital funding. Visit coinbase.com/signup and blockchain.info to find out more. If you plan to buy cryptocurrency, you must arm yourself with as much knowledge as possible to avoid the conmen. According to analysis by digital threat firm RiskIQ two years ago, the world’s top app stores were hosting more than 600 blacklisted bitcoin apps which leave users open to hackers.

There are a couple of crypto wallets that position themselves as all-in-one solutions for cryptocurrency operations. Lumi Wallet, after the latest update, is one of a few to actually withstand those claims, allowing both the purchase and withdrawal of crypto to a credit card.