Content

AmountConsideration£160,000 x (3,500 / 4,000)£140,000Less allowable costs£200,000 x (3,500 / 14,000)£50,000Gain£90,000Melanie still holds a pool of 10,500 token B. For example, if a person owns BTC, Ethereum and Litecoin, they would have three pools and each one would have it’s own ‘pooled allowable cost’ associated with it. HMRC confirms that cryptoassets may be pooled under section 104 TCGA 1992 subject to the 30-day bed and breakfast rule. Where the assets are equity-linked, reliefs should be considered and where debt-linked, exemptions considered.

It’s often the case that individuals and companies entering into transactions consisting of buying and selling cryptoassets will describe them as ‘trades’. However, the use of the term ‘trade’ in this context is not sufficient to be regarded as a financial trade for tax purposes. Only in exceptional circumstances would HMRC expect individuals to buy and sell cryptoassets with such frequency, level of organisation and sophistication that the activity amounts to a financial trade in itself. If it is considered to be trading then Income Tax will take priority over Capital Gains Tax and will apply to profits as it would be considered as a business. If you sell Bitcoin at a profit you will be able to set against it your available capital gains tax annual exemption, currently £12,300.

Bitcoin Can Create Some Sticky Tax Situations

If you haven’t been keeping accurate records of your crypto trades so far, you can use cryptocurrency tax software to organize your transactions perfectly. Where a person is tax resident in the UK, but is not domiciled in the UK, they may elect for the remittance basis. This allows a person to escape UK taxation on foreign income and gains until those foreign income and capital gains are remitted to the UK, and indefinitely otherwise.

There are thousands of other forms of crypto assets which are less currency like and can have other attributes which can make them necessarily a form of tokens tradable on different platforms worldwide. Your overall earnings determine how much of your capital gains are taxed at 10% or 20%. And so irrespective of your view on the validity of cryptocurrency, you will always be liable to pay tax on your investment profits from them. If you have used a cryptocurrency to purchase software or gaming points, it is unlikely that you have made a profit and HMRC will not be worried about you.

Trump takes dig at Japan for ‘substantial’ trade advantage and These lessons from the ultra wealthy can help your family grow a fortune that will last for generations. When you realize a capital gain you sold your crypto for more than you purchased it for , you owe a tax on the dollar amount of the gain. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. College financial planning programs are hoping they can help fill those seats.

Crypto Trading 101: How To Read An Exchange Order Book

They calculate your gains or losses and automatically populate tax reports with your data. You should obtain tax relief on the costs of trading, as in buying and selling. If a company realises a capital loss on the disposal of exchange tokens, this can be used to reduce an overall gain on total capital disposals provided the loss is reported to HMRC and accepted as allowable. If a sole trader holds exchange tokens as an investment, they are liable to pay CGT on any gains they realise.

- In most cases, companies are often prohibited by their Articles of Association from straight up gambling.

- As cryptoassets are pooled, the negligible value claim needs to be made in respect of the whole pool, not the individual tokens.

- Exchange tokens are intended to be used as a method of payment and encompasses ‘cryptocurrencies’ like bitcoin.

- Employers must account to HMRC for the Income Tax and National Insurance contributions due through the operation of PAYE, based on the best estimate that can reasonably be made of the cryptoassets’ value.

- Residential property -two marginal rates of 18% and 28% depending on one’s annual income.

We can confirm for you the tax impact that any purchases or sales may have and advise you on how to best manage that tax exposure. Having a tax specialist who is experienced with the issues relating to cryptocurrency business, traders and investors can offer you peace of mind. We ensure that your affairs are structured properly, are compliant with HMRC and can help resolve any HMRC investigations, allowing you to focus on your business or investments. VAT is due on any goods or services sold in exchange for cryptoasset exchange tokens.

This means that any time a CGT event occurs, such as when you sell off some of your cryptocurrency and realise a capital gain, you will incur CGT. The profits and losses of a non-incorporated business on cryptocurrency transactions must be reflected in their accounts and will be taxable on normal income tax rules. When you buy bitcoin or cryptocurrency, nothing is expected of you at the point of sale. You will however need a record of the price you bought it at to calculate gains or losses and the subsequent taxes when you sell it in the future. It is noted that most exchanges will let you download CSV files of your trades. At least try to take a screenshot of recent transactions you have made if possible, your accountant will love you for it.

eToro is the world’s leading social trading platform, offering a wide array of tools to invest in the capital markets. Create a portfolio with cryptocurrencies, stocks, commodities, ETFs and more. Where wages/salaries are paid using cryptocurrency, the value of the emolument for the purposes of calculating payroll taxes is the Euro amount attaching to the cryptocurrency at the payment date. In most circumstances, cryptoassets are held as personal investments by individuals . In this case, individuals will be liable to pay Capital Gains Tax when the cryptoassets are sold.

How Will I Know If I Am Subject To A Hmrc Investigation Into My Cryptocurrency?

If you are buying and holding your investment and then selling according to the market conditions, you are investing, and your gains or losses will be taxed as capital. HMRC published their capital gains tax guidance in December 2017, so in theory tax returns for 2016/2017 which were submitted by 31st January 2018 should have been completed on the basis set out in the guidance. These returns can still be amended, and again this would need to be done by 30th September 2018 as otherwise there is a potential exposure to significant penalties.

Whenever your total capital gains and losses for the year add up to a negative number, you incur a net capital loss. But while all order books serve the same purpose, their appearance can differ slightly among exchanges. What you need to know It looks like will be a landmark year when it comes to the IRS and taxing cryptocurrency gains. You should have a record of the amount of crypto received and the date and time that you received it. Hardforks – Where a fork results in a new cryptoasset being created, the individual must allocate a share of the cost of the original cryptocurrency to the newly acquired or created cryptoasset. This does not create a tax liability but does ‘split’ the cost of the old asset, so that a future disposal may result in a greater liability.

How Is Cryptocurrency Taxed?

If these cryptoassets are transferred out of trading stock, the business will be treated as if they bought them at the value used in trading accounts. Businesses should use this value as an allowable cost in calculations when they dispose of the cryptoassets. As with any activity, the question whether cryptoasset activities amount to trading depends on a number of factors and the individual circumstances. Whether an individual is engaged in a financial trade through the activity of buying and selling cryptoassets will ultimately be a question of fact.

Do Forex traders pay tax in USA?

Forex Options and Futures Traders

Forex futures and options are 1256 contracts and taxed using the 60/40 rule, with 60% of gains or losses treated as long-term capital gains and 40% as short-term. Spot forex traders are considered “988 traders” and can deduct all of their losses for the year.

Unlike utility or security tokens, they do not provide any rights or access to goods or services. In most cases, an individual buying, holding and selling cryptocurrency on their own account will be deemed to carry on an investment activity and subject to capital gains tax. In most circumstances, a person who trades on their own account is unlikely to meet the description of a ‘trader’ for income tax purposes and will more than likely fall within the capital gains tax regime. If the threshold of trading is met, the net profits will be subject to income tax at 20%, 40% and 45% and national insurance at 12% and 2%. For example, the most obvious would be the ‘day-trader’ who is actively buying and selling cryptoassets with the view to realising a short-term profit. Even in these circumstances, it is generally difficult to fall within the description of a ‘trader’ and HMRC generally accept that individuals will be subject to the more favourable rates of capital gains tax . Individuals and businesses should expect to be taxed on cryptocurrencies as if they were buying and selling other assets.

Similarly, cryptocurrency received as income, or income created by cryptocurrency trades, will be treated as such. Income tax will not be payable on cryptoassets received without doing anything in return and/or not as part of a trade or business involving cryptoassets (e.g. Airdrops). If the special rules apply, the new crypto assets and the costs of acquiring them stay separate from the main pool. The gain or loss is calculated using the costs of the new tokens of the crypto asset that are kept separate. Cryptocurrency will be within capital gains tax if it is an “intangible asset”, which includes a bundle of rights arising under a contract. It seems likely that most cryptocurrencies will fall within this definition. As set out in more detail below, there may be cases where the individual is running a business which is carrying on a financial trade in cryptoassets and will therefore have taxable trading profits.

Easy – trading in cryptocurrencies are exempt supplies for VAT purposes. If you need HMRC Tax Investigation advice, we are available to aid you at every stage of the HMRC investigate process. Members of our legal team have first-hand experience and knowledge of the internal workings of HMRC. Our team specialises in successfully challenging HMRC decisions and will assist you in every aspect of the investigation. It is likelyHMRCwill now discoverbitcoinholdings as they begin to contact the biggest cryptocurrency exchange websites. However, HMRC utilise the Cryptoasset Taskforce report in considering that cryptoassets are not currency or money.

Note that miscellaneous losses can only be carried forward against future miscellaneous profits. Keeping up changes and the amount of tax you are expected to pay on your cryptocurrency, can be overwhelming. With all financial commitments, if you don’t pay the correct amount of tax there may be heavy penalties for you and your business. As with all taxes, if you’re avoiding payment or not paying your share, HMRC are in their rights to contact you and carry out compliance checks. It’s therefore extremely important to make sure you’re paying what you owe.

Content on eToro’s social trading platform is generated by members of its community and does not contain advice or recommendations by or on behalf of eToro – Your Social Investment Network. This will assist you in preparing your tax return as having all the information safely on hand will save you time in the long run. It may also be helpful to look into our convenient Crypto Tax Calculator which can save you time by automatically pulling in your transactions and giving you a rough idea of what your tax situation may look like.

Cryptoassets Provided In The Form Of Readily Convertible Assets (rcas)

Sadly HMRC does not regard this as a disposal on which a capital loss can be claimed on the basis that the asset is still there – you just can’t access it. As a final quirk, however, if you were to keep the awarded assets, then the activity would be viewed as investment and you may have to pay Capital Gains Tax on any gains. If the cash is not required in the short term, it may be left in the company until it is wound up, at which time entrepreneurs’ or investors’ relief can be utilised to reduce the tax rate to 10%. By default, crypto-assets are treated as Chargeable Assets, meaning they are only taxed on disposal, with costs not relievable until they can be offset against proceeds . Whether you decide to run your cryptocurrency investment activities as an individual or a limited company, each structure comes with its own unique set of advantages and disadvantages. But the option that’s right for you depends on the type of cryptocurrency activities you undertake. The most popular legal structures in the UK are sole trader and limited company.

The capital gains tax legislation sets out specific rules, the pooling rules, which apply to “securities”. There has been debate about when cryptocurrencies are securities for regulatory purposes, but the tax definition is much wider. If a profit on cryptocurrency is subject to tax as a trading profit, then it is not also subject to capital gains. The question of what trading is, is a wide subject and not addressed in this article. However, as amateur day traders in stocks and shares are not treated by HMRC as trading, it seems likely that in many cases crypto transactions will be treated as resulting in capital gains or losses.

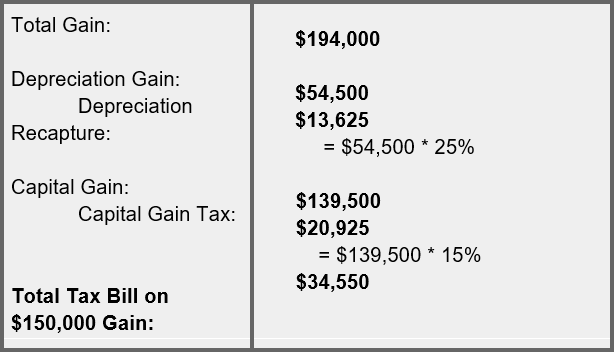

Note that HMRC will consider on a case-by-case basis whether a transfer of exchange tokens meets the above definitions for stamp duty or stamp duty reserve tax to apply. HMRC’s initial view at the time it published its guidance was that existing exchange tokens would not be likely to meet the above definitions. Costs of making a valuation or apportionment to be able to calculate gains or losses. Mining using a bank of dedicated computers bought for that specific purpose and in the expectation of a profit would probably be trading activity. AmountConsideration£300,000Less allowable costs£126,000 x (50 / 150)£42,000Gain£258,000Victoria will have a gain of £258,000 and she will need to pay Capital Gains Tax on this. If some of the tokens from the pool are sold, this is considered a ‘part-disposal’. A corresponding proportion of the pooled allowable cost would be deducted when calculating the gain or loss.

The UK is also seeing some moves in this direction, and the HMRC (Her Majesty’s Revenue and Customs) has recently asked top crypto exchanges for details on UK-based crypto investors. Experts believe that this means that the HMRC might be heading in the same direction as the IRS. It should be remembered that HMRC’s guidance is based in its interpretation of existing tax laws that were not designed for cryptoassets. Therefore, although it is a helpful steer to their tax treatment, the tax law may evolve over time, as tax disputes over cryptoassets are tested in the law courts. The employer should treat the payment of cryptoassets which are not RCAs as payments in kind for National Insurance contributions purposes, and pay any Class 1A National Insurance contributions to HMRC. Cryptoassets received as earnings from employment, which do not meet the definition of RCAs, are still subject to income tax and National Insurance contributions.