Content

Start leveraged trading on cryptos against fiat currencies and other alt coins. Skilling offer crypto trading on all the largest currencies available, with some very low spreads.

What is the safest platform to buy Cryptocurrency?

The 5 Best Cryptocurrency Trading SitesCoinbase.

Binance.

Robinhood.

Gemini.

Kraken.

People who got ahead of the curve and started cryptocurrency trading when it first burst onto the scene, now sitting on a wealth of profit. To deposit funds, one would need to purchase BTC, ETH or any other deposit cryptocurrency from third-party sources and have it transferred to their third-party wallet. The funds are then transferred from this wallet to the wallet provided by the crypto exchange for depositing that cryptocurrency. If you choose to use this method, you should ensure to enter the wallet addresses properly when conducting the transactions, as any crypto transferred to a wrong address cannot be recovered.

Designed For Digital Asset Exchanges

The process involves buying or selling contracts based on the price movements of the underlying cryptocurrency in question. Once your exchange wallet has been credited, you can buy and sell cryptos by trading the pairs that contain the deposit currency you have chosen. BTC and ETH usually have the largest number of pairings on any exchange, so you will not be short of what to trade on the exchange. You will be able to use Limit orders (‘Close at Profit’), Stop Loss orders (‘Close at Loss’), or future orders to Buy/Sell your preferred digital cryptos. The process involves looking for a cryptocurrency pair in order to perform a crypto-to-crypto exchange or exchanging crypto for fiat or fiat currency for cryptos. The transaction is done twice, and in opposite directions to complete an exchange cycle with the goal of profiting from the exchange. The early phases of younger cryptocurrency exchanges are inevitably characterized by minimal volume.

Given that the market for cryptocurrencies is relatively new, the legal nature of cryptocurrency is – in most jurisdictions – yet to be determined by statute, regulation or case law. In the absence of such authority, it is not clear how a regulator or court may treat interests or rights arising trading in cryptocurrency. In particular, the law applicable to firms who hold cryptocurrencies in custody (particularly in the event of such firms’ insolvency) is far from clear. The market for the Supported Cryptocurrencies is still relatively new and uncertain. The price or value of cryptocurrency can rapidly increase or decrease at any time and may even fall to zero. The risk of loss in trading or holding an interest in cryptocurrencies can be substantial and can result in the loss of the entire value of your interest in cryptocurrency.

They can check whether they have sold or purchased the currency with detailed information of date and time. The Coinbase app provides its users with the details of the past transactions and balances. This is one of the other important features that need to be considered while developing a bitcoin-like mobile application. This would enable the users to see their past transactions and keep a check on the most recent activities. 76% of retail investor accounts lose money when trading CFDs with this provider. For 30 years, City Index customers have enjoyed fast, reliable trading and actionable ideas alongside access to a wealth of research.

76.4% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Indisputable Facts That Will Help You Understand Bitcoin Better

It is highly important to be kept in mind because if you are a beginner, you are going to face very complications if you choose Egypt currency exchange that is not at all user friendly. The interface must be very easy to understand and must be very attractive to not get bored. In order to find a perfect or currency exchange, there is a long list of important considerations that you have to keep in mind. The first thing that you have to keep in mind is nothing else but the security of the cryptocurrency exchange you will choose. You can also read about the cryptocurrency exchange in the about section that you will find on the homepage of the exchange. Given the various risks attaching to cryptocurrency exchanges , it is possible that a Cryptocurrency Exchange could suspend or terminate its relationship with us and sometimes won’t tell us why. Instead, cryptocurrencies are an as-yet autonomous and largely unregulated worldwide system of currency.

Having settled on a trading strategy, you will need to define your ‘close’ conditions – i.e. the point that you will exit a trade. Cryptocurrencies are volatile and running large open positions is risky. Once a position has reached your target, or you have hit your maximum loss, you will need to close out your position. Starting small or testing your knowledge with a demo/practice account can help you get a feel for how these markets work and what influences them. The pricing of cryptocurrencies depends on a whole host of factors. The more people become involved in cryptocurrencies, the more influential these different factors will become.

Both activities are undertaken with the intention of making a profit by trading in the crypto market, but the processes involved are very different. This article describes how to buy and sell cryptos, as well as how to trade cryptocurrency CFDs.

The users are never going to miss another opportunity to use the app with the best features. Let them set the prices of cryptocurrencies at which they are looking to sell or purchase them. Coinbase is operating since 2011 and was founded by its two partners Fred Ehrsam and Brian Armstrong.

Use your USD, EUR or RUB to buy and sell cryptocurrency at competitive exchange rates and with high maximums for verified accounts. Being forced to miss out on a trading opportunity because your trading funds took too long to arrive into your exchange account can be a frustrating experience. Spending day after day waiting for a withdrawal to arrive in your bank account or crypto wallet can also be extremely stressful, so check average processing times before you register. If privacy is important to you when trading cryptocurrency, there are some platforms that allow you to transact anonymously.

Localbitcoins.com is a peer-to-peer marketplace that escrows digital currency. Transactions can be completed using cash, wire transfer, PayPal, SEPA, or direct bank deposit. When LocalBitcoins is used, a person must register using an email I.D., and some sellers require a KYC check. Since LocalBitcoins acts as an escrow manager, the sellers set all of the rules and standards. With that in mind, buyers should always check the reputations of sellers. CEX.io doesn’t have a very long list of cryptocurrencies available. If it has never been in the cryptocurrency top ten by market cap, you can be sure you won’t be able to buy it at CEX.io.

How To Trade Cryptocurrency

This means you need to create an exchange account and store the cryptocurrency in your digital ‘wallet’. User experience and functionalities is a critical factor to consider, especially if you’re trading cryptocurrency for the first time. Exchanges with good user experiences attract the largest growth in transaction volumes.

Digital asset exchanges should see increasing volume and commission revenue as the cryptocurrency market matures and expands. The technology underlying these exchanges allows users to trade in a very liquid and flexible market. As a result, there is never a point where one type of virtual currency overruns another.

Products For Crypto Exchanges

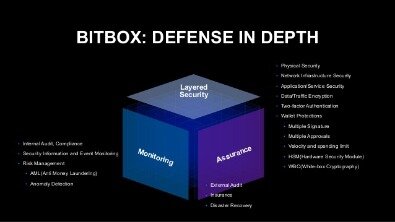

You need to find a cryptocurrency exchange perfect in its services to make huge returns from bitcoins. Today, we are going to tell you about some important considerations that are necessary to be kept in mind for finding a reliable cryptocurrency exchange from over the internet. Digital Asset Exchanges and other crypto companies require the best security to protect their customers cryptocurrency wallets without compromising in control flexibility and scalability. CYBAVO VAULT SOFA is a One-stop exchange solution for cryptocurrency exchanges and other companies working with digital assets. As a mass wallet management platform it is designed to integrate their end users’ wallets with the secure digital asset storage provided by CYBAVO VAULT.

Of course, if it’s too easy to create an account and start trading, consider whether there’s anything to stop a platform from disappearing overnight. From deposit through to trading and then withdrawing funds, how much will it cost you to buy and sell crypto on each platform from start to finish? Remember to consider your payment method, the currencies you want to use and any discounts you may be entitled to when completing these calculations.

However, the majority of exchanges across the world accept crypto-based methods of transaction, due to restrictions placed by banks on such exchanges in operating bank accounts. If the exchange only accepts cryptocurrency deposits/withdrawals, the trader must additionally create a third party wallet for the cryptocurrency to be used in performing the deposits. The most common cryptocurrencies used for deposits are Bitcoin, Ethereum and Litecoin. The buying and selling of cryptocurrencies is done on cryptocurrency exchanges. A trader needs to open an exchange account by filling out an online form. Most exchanges feature an order book that will indicate what traders are buying and selling and where they are doing this. There is a difference between buying/selling cryptocurrencies on an exchange and trading cryptocurrency CFDs on a CFD platform.

A Look At The Cryptocurrency Exchange Architecture

finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions. While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products. Please don’t interpret the order in which products appear on our Site as any endorsement or recommendation from us.

Today, cryptocurrency forms a major part of their portfolio as experts in trading, spread betting and managing risk effectively. Thorough research will help you choose a secure and legitimate exchange platform. There are a lot of incompetent exchanges that not only expose investors to fraud, but also end up scamming the little investments left by online scammers.

- This would enable the users to see their past transactions and keep a check on the most recent activities.

- Each countries cryptocurrency tax requirements are different, and many will change as they adapt to the evolving market.

- The absence of centralisation means there’s no single point of failure for hackers to target, and server downtime is no longer an issue.

- The cryptocurrencies have been revolutionizing the way the financial industry is working and developing.

- You should carefully assess whether your financial situation and tolerance for risk is suitable for any form of exposure to cryptocurrencies.

- Understanding and accepting these three things will give you the best chance of succeeding when you step into the crypto trading arena.

When choosing your broker and platform, consider ease of use, security and their fee structure. There are a number of strategies you can use for trading cryptocurrency in 2017. Whichever one you opt for, make sure technical analysis and the news play important roles. Finally, keep aware of regional differences in rules and taxes, you don’t want to lose profit to unforeseen regulations. The most useful cryptocurrency trading tutorial you can go on is the one you can give yourself, with a demo account. Firstly, you will you get the opportunity to trial your potential brokerage and platform before you buy.

An order module for buying and selling, halting and limiting orders will also be needed. And finally, a trading view, which is an external component for graphs including candlestick charts and basic indexes. This should comfortably be finalised in as little as 3 weeks. The first of these is the order book, or trading module, which may be delivered in approximately 9 weeks for a team of 3 developers.

Before diving in head first, you’ll need to be aware of what to look for when it comes to the best Bitcoin exchange for your specific needs. Whilst there are many options like BTC Robot that offer free 60 day trials, you will usually be charged a monthly subscription fee that will eat into your profit. They can also be expensive to set up if you have to pay someone to programme your bot. On top of that, you’ll need to pay to have your bot updated as the market changes. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. Analyse historical price charts to identify telling patterns. History has a habit of repeating itself, so if you can hone in on a pattern you may be able to predict future price movements, giving you the edge you need to turn an intraday profit.